When it comes to overseas employment, the Philippines is one of the most globally mobile nations. To financially support their families, each year Filipinos send back home more than $30 billion in remittances. In this article we talk about sending money to GCash, the most popular e-wallet in the Philippines, and compare GCash money transfers via three major providers: Revolut, Remitly, and Profee.

Sending money to GCash

With over 76 million users, GCash is the leading digital ecosystem in the Philippines supported with nearly 650,000 physical cash points. GCash balance allows its users to send and receive money, pay bills, buy mobile credits, pay for online shopping, and so on. The superapp also offers some advanced features like investments, loans, insurance, and transactions in non-traditional payment means such as cryptocurrencies. For the users’ convenience, GCash customer service offers a large Q&A database and operates a 24/7 chatbot. It is no surprise then that a number of global remittance providers have incorporated GCash money transfers into their offerings.

How to send money to GCash? As a rule, the process is straightforward. Having logged in to the system of their remittance service, the sender should simply select GCash as their delivery method and provide the recipient’s name and mobile phone number.

There are, however, several important details to keep in mind when sending money to GCash.

- The recipient must sign up with GCash and fully verify the account before the transfer.

- The full name and the phone number of the recipient provided on the sender’s side must be the same as those registered with GCash. Otherwise, the system will not be able to locate the recipient, or the transfer might be misdirected which may invoke lengthy communication with the GCash customer service.

- Before sending money to GCash, it is recommended that the sender clarifies the recipient’s e-wallet cash-in limits. This would help them to avoid unnecessary complications and, again, the need to involve the GCash customer service.

Wire transfers

The most popular option of sending money to the Philippines is still via a bank, that is, as international wire transfers which account for 57.2% of all remittances flowing into the country. The bank must be integrated with GCash, and there are several in the Philippines that allow this kind of transfers, among them BPI, UnionBank, and Maybank. However, for such transfers to GCash, fees can be prohibitive, reaching up to 10% of the transaction amount in some cases. Furthermore, a part of the charge may be hidden and transpire only after the money has been sent.

Cryptocurrencies

Even though the Philippines is rapidly adopting new technologies, dealing with cryptocurrencies is still an activity for the most advanced technology users. If your recipients are not exactly that, for example, your parents, then this method of sending money to GCash might not be the most convenient for you.

Online money transfer systems

Over 41% of all remittances to the Philippines are sent via an online money transfer provider, and this number has been steadily growing. Let us have a look at how to send money to GCash via three services popular in Europe.

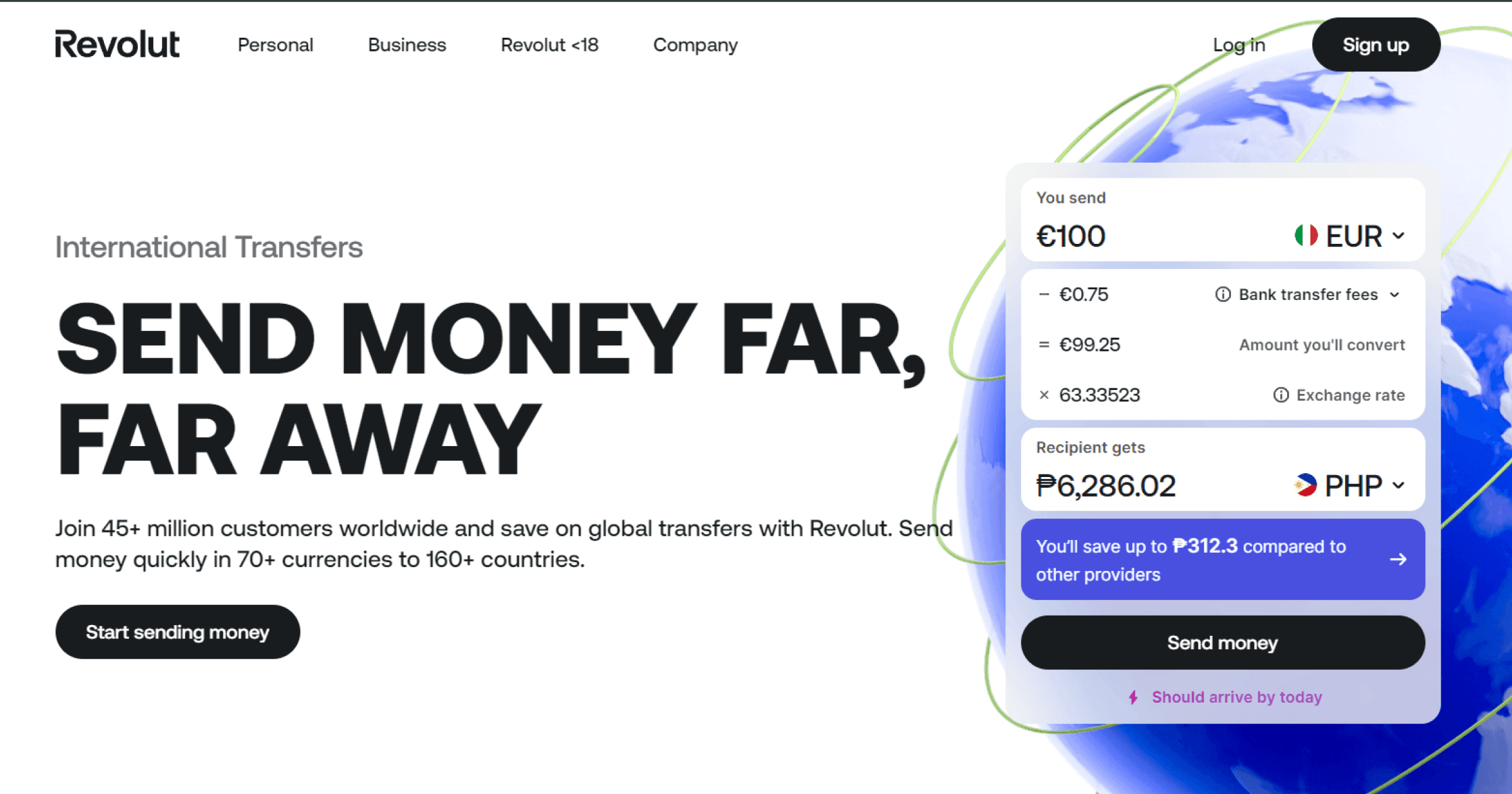

Revolut

This fintech provider offers money transfers to the Philippines among other services. However, if you are looking how to send money to GCash via Revolut directly, currently there is no such option. Instead, you can send a transfer to a linked card or a bank account so that the money could be added to the GCash balance. Here, when cashing out, additional GCash fees may apply. To learn about the conditions of a transfer, you first need to sign up with Revolut. And since it is a rather complicated fintech ecosystem, the registration process is also quite demanding in terms of the details you need to provide, including your tax credentials. Therefore, if you simply need to send some money, Revolut might not be the simplest and most convenient option.

Remitly

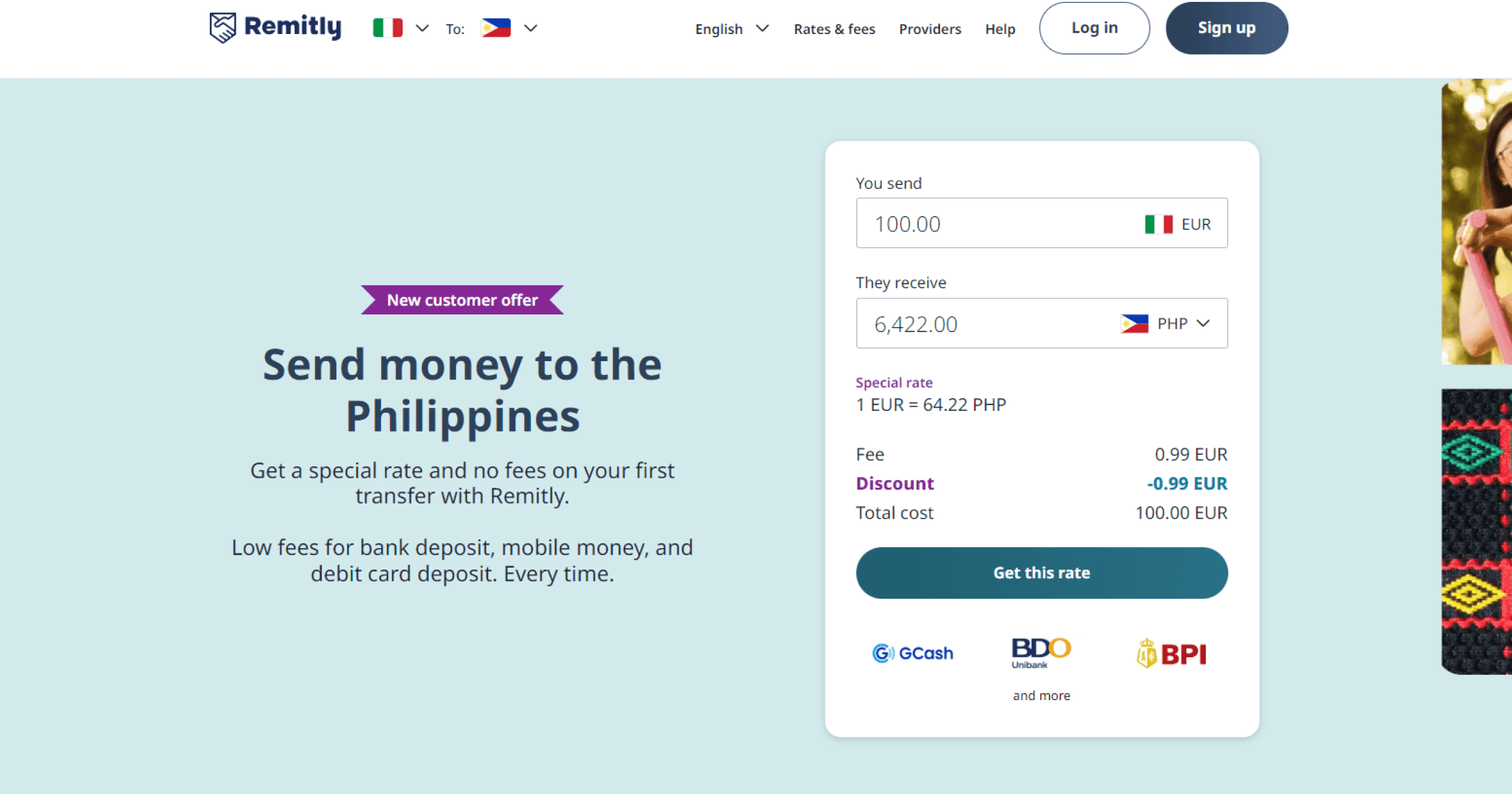

Remitly is a US-based fintech provider that offers money remittance services, including from Europe to the Philippines. It also allows transfers to GCash. The registration process with Remitly is standard: as a sender, you need to provide some personal information about yourself and confirm your phone number.

Now, how to send money to GCash with Remitly? When arranging a transfer, you need to select Mobile Money – GCash option as your delivery method and provide the recipient’s details: name, middle name (optional), surname, and GCash-registered mobile number in the 09* format. As a reminder, for the money to be added to the GCash balance the recipient must verify their account there.

Using a credit card to pay for a transfer involves a fee of 3% whereas transfers to GCash via a bank may take up to 5 business days to complete. The charge also depends on the selected speed of delivery (higher fees for faster transfers) and the amount sent.

Profee

If you want to have some real benefits when sending money to GCash, however, it is a good idea to try Profee, an online money transfer provider licensed in the EU and compliant with all financial and industry regulations. Profee offers a simple, cutting-edge solution for sending money internationally. For GCash money transfers, it is not only the most convenient but also the most beneficial way thanks to:

- A special promo exchange rate for the first transfer from Europe to GCash via Profee

- No commission on all such transfers.

The registration process is very simple and Profee is fully transparent about its pricing: you know the exact amount to be delivered before any money is sent. It also offers the most competitive currency exchange rates for all European currencies to peso, thanks to its unique market monitoring system. Through its referral programme its customers can not only send but also earn unlimited amounts of money by inviting their friends to try the service. Join Profee by visiting www.profee.com or getting the app from Google Play or the Apple Store to unlock even more benefits and be able to support your family in the Philippines at any time.