Sending money abroad from Ireland doesn’t have to be overwhelming! If you want to send money from Ireland to Moldova or Romania, this guide will help you navigate the options. We’ll explore the best transfer methods, fees, exchange rates, and some handy tips for quick and secure transfers. Let’s dive in!

Moldovans and Romanians in Ireland

How to transfer money from Ireland

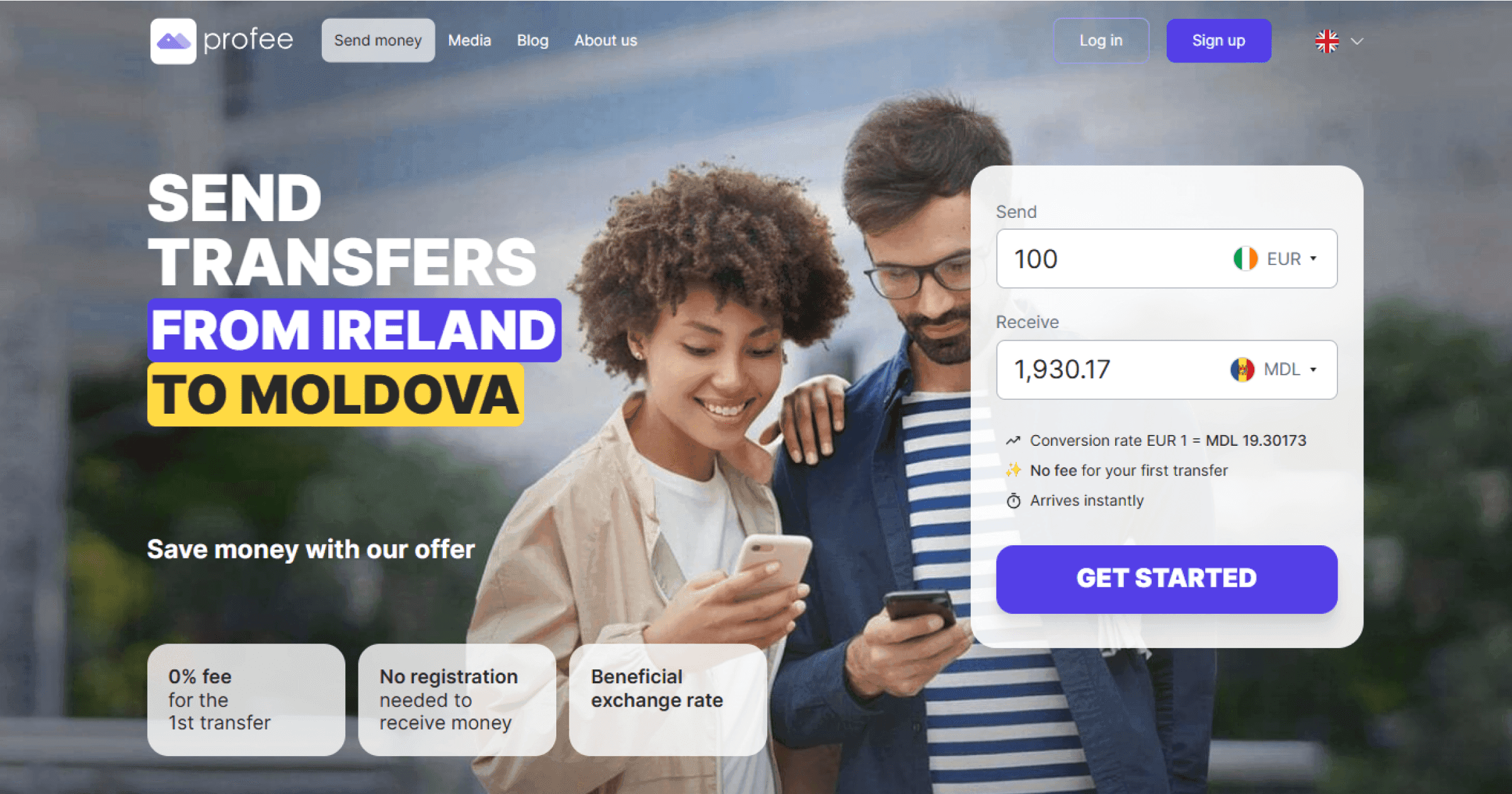

Sending money from Ireland with Profee

Tips for fast and secure transfers

Moldovans and Romanians in Ireland

Approximately 130,000 Moldovans and Romanians live in Ireland. Their reasons for moving vary from education to working opportunities and running a business, but what unites all of these expats is the need to send money from Ireland. To do it effectively and efficiently, migrants should consider opening a local bank account. The reasons are simple — getting your salary, paying for your groceries and sending money back home. To choose a bank that suits your needs the most, read our article about the best Irish banks for expats. Done? Now, we can explore ways of sending money to Romania and Moldova without spending a fortune.

If you want to learn more about managing your budget wisely, check out our article.

Transfer methods

Bank transfers

Bank transfers are the classic way to send money abroad from Ireland. Most banks in Ireland offer international transfer services.

Pros

- Reliable and secure.

- You can send large amounts of funds at once.

Cons

- Fees can be steep, reaching tens of euros.

- Not the best exchange rates.

This is an option for those who are ready to overpay for the sake of security. But our sixth sense tells us that we can find more attractive options, so we should continue our research.

Cryptocurrency

For those who know how to tap the hamster (joking… or not?)

Cryptocurrency is gaining more popularity as an option to send money online from Ireland. The process is as follows: convert euros to a digital currency, then use your uno-reverse card to convert digital currency to leu.

Pros

If you’re educated on the cryptocurrency processes and know how it works, then crypto transfers may be:

- Advantageous: low transaction fees.

- Fast: crypto transfers are pretty quick when you get used to it.

- Flexible: plenty of options to choose between.

Cons

- Cryptocurrencies can be volatile, affecting the amount your recipient gets.

- Not everyone is familiar with cryptocurrencies, which can complicate the process.

- You may become a victim of fraud when sending money to Romania or Moldova. Crypto is not the only platform that scammers love to use, watch out for other phishing schemes as well.

At this point, cryptocurrency transfers suit people who have the energy and time to research the topic deeply. If you're one of those, learn carefully and be aware of scammers.

Online money transfer services

If you want something quicker and cheaper, online services are a fantastic choice: competitive rates and adequate fees make it attractive to send money from Ireland online.

Popular options

- Wise: Known for transparency and security, Wise makes transferring processes quick and cost-effective.

- Revolut: This banking app lets you send money abroad from Ireland at great rates and offers a multi-currency account.

- PayPal: While widely used, keep an eye on fees and exchange rates, as it may be higher than you would like to.

- Profee: The most convenient way to transfer money to Romania and Moldova. Period. And here’s why.

Why choose Profee?

- Cost-effective and transparent fees

Profee offers incredibly competitive rates, with 0% fees on the first transfer from Ireland to Moldova and Romania. Unlike many traditional banks, Profee provides exchange rates close to the market rate (and sometimes even more advantageous than you find on Google, which is crazy), ensuring you get more value when sending money from Ireland. It's an excellent choice for those seeking the cheapest way to send money to Moldova and Romania.

- Fast and convenient

Fast like Formula 1 cars — Profee allows quick transfers from card to card, often within minutes. This speed is especially beneficial for urgent remittances, providing peace of mind for both the sender and the recipient. It's one of the best ways to quickly transfer money to Romania and Moldova.

- High security standards

At Profee, your safety is our top priority. We adhere to stringent security measures, including 3D Secure technology for card transactions and PCI DSS compliance, helping protect against fraud and data breaches. With Profee you can send money online from Ireland without worrying about the safety of your funds.

If you have no idea what PCI DSS is and why you should trust these random letters, find an explanation in our article.

- Versatility in transfer options

Whether you’re sending money abroad from Ireland, Profee is a flexible option because you can send money from a card, Apple Pay or Google pay — whatever meets your needs the most.

Tips for fast and secure transfers

Choose wisely: research the platform to send money to Moldova and Romania that suits your needs best regarding speed, fees, and exchange rates.

Double-check details: always verify the recipient's bank account info or crypto wallet address to avoid mistakes.

Know your limits: some services may have limits on the amount you can send, especially for first-time transfers, so be aware to avoid delays.

Timing matters: if you're sending money abroad from Ireland around holidays or weekends, be prepared for longer processing times. Plan ahead!

Stay informed: different countries have varying regulations on money transfers, so make sure you know the rules in both Ireland and the recipient’s country.

Boost security: when sending money online from Ireland, enable two-factor authentication for added security during transactions.

Or

Just use Profee to think less, spend less and worry less! Because:

You can save your and your recipient’s data — no more typos.

Making transfers is fast and easy, you can do it on the go.

Our support team is here to help: you can contact them directly in the app or via email at help@profee.com.