At the beginning of each year, Polish employers send the PIT tax-11 document to all employees. But only some know how to use it and the difference between PIT 11 and 37. Let's have all the questions answered!

Income tax is mandatory not only for citizens of Poland but also for all foreigners who officially work on the country’s territory. Ukrainians in Poland must complete a declaration even if they have worked in Poland for a short time, say one day. In 2023, the tax service in Poland will start accepting employees’ PIT declarations from February 15, 2023, to May 2, 2023.

What is PIT tax and who it applies to

PIT stands for Personal income tax. It is a tax paid by all working people. If you work for an employer or are a private entrepreneur, you must pay tax on the income you receive from the Polish treasury. Poland has several types of PIT tax and additional income declarations:

PIT-36 – economic activity;

PIT-36-L – linear tax;

PIT-37 – income from work (wages);

PIT-38 – securities;

PIT-39 – income from real estate.

What is PIT-11?

PIT-11 is a document that indicates how much money was earned, paid in taxes, and received by a particular person. The employer fills in the information for each employee. If Ukrainians in Poland work in several places (for different employers), they receive a PIT-11 from each employer.

According to the personal income tax document, you must pay 27% tax from your salary annually. The amount of the tax from your expected income is paid in advance. Only the following year, the Polish tax authorities can calculate the exact tax amount. Often these amounts do not coincide.

What is PIT-37?

PIT-37 is a tax report form that you fill out yourself. What is the difference between PIT-11 and PIT-37? You receive PIT-11 from your employer by the end of February. After that, you transfer the information from it to PIT-37 and submit it to the appropriate department.

By February 15, 2023, the Ministry of Finance of Poland will independently prepare a PIT-37 income declaration for 2022 for every employed person in the country. The document will be available on the official state website in the ‘Taxes’ category. To access it, log in through a trusted profile. Most refugees from Ukraine receive such a trusted profile together with a PESEL number.

Please note that if you worked in Poland for several companies during 2022, you should receive separate PIT-11 declarations from each of them – all your taxes must be calculated. Each must be indicated in the PIT-37 reporting form for 2022.

Who should pay taxes in Poland?

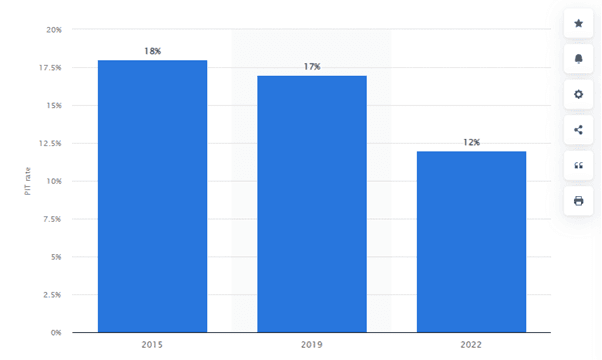

PIT rate in Poland from 2015 to 2022

Ukrainians in Poland can be considered as:

- Tax residents – then in Poland, they pay tax on all income, including earned outside of Poland or;

- Tax non-residents – in Poland, they pay tax only on the income received in the country.

When you start working, you should ask the employer how the tax year will be calculated and whether you will be considered a tax resident of Poland. Many employers require a foreigner to provide a certificate of tax resident status. Mind that employment of foreigners in 2023 should be computerised. Obtaining a work permit and accepting an application for work assigned to a foreigner will take place through the already existing IT system.

Do Ukrainians in Poland who work in Ukrainian companies have to file PIT-37 in 2023?

On September 7, 2022, the Ministry of Finance of Poland stated that all citizens of Ukraine who have spent more than 183 days in Poland and continue to work remotely for Ukrainian employers are recognised as tax residents of Poland. Therefore, they must pay taxes to the Polish budget and submit appropriate reports.

How to pay the PIT tax?

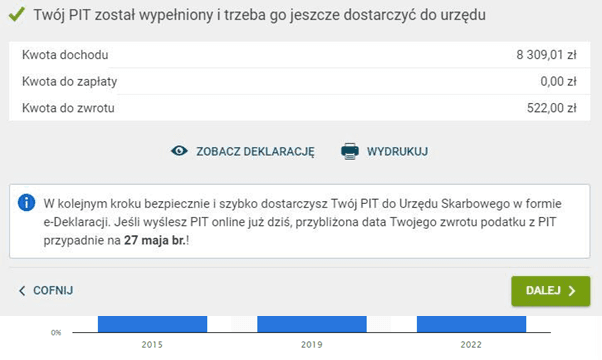

The PIT-37 declaration must be submitted by May 2, 2023. You may be obliged to pay the corresponding personal income tax if the amount deducted from your income after the final calculation is less than the tax from the total revenue.

If you pay extra, you can get the difference back

If you pay more than needed, you can get the difference back. In this case, the tax inspectorate will check all the data, and the money will be returned to you if there are no errors. Otherwise, you will have to pay the shortfall.

Ways to file taxes in Poland

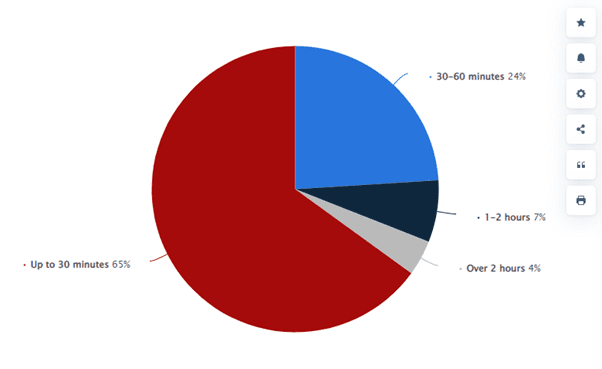

Duration of filling PIT tax return in Poland 2021-2022

The declaration can be submitted on paper at one of the tax inspectorate offices at the place of residence or online.

In 2023, it is possible to regulate tax obligations on the website of the electronic tax inspection using BLIK. BLIK is a Polish service that allows you to pay quickly and easily in a store and online and deposit and withdraw cash. Both individuals and entrepreneurs can use it. BLIK payments are available for PIT calculations (PIT-28, PIT-36, PIT-37, PIT-38, PIT-39).

What else do you need to know about taxes?

Ukrainians getting a job abroad sometimes hope that the income tax department will not find out about their foreign income. However, this is far from the case.

First, fiscals can get information about the availability of income from Ukrainian banks. For example, if a foreign employer transfers remuneration to an account in a Ukrainian bank or an officially unemployed person opens a significant deposit for a considerable amount. Secondly, tax information is exchanged between the Ukrainian income tax department and other countries. The people who have underpaid taxes may even be held responsible and face trial in court.

Financial operations may be a pressing matter sometimes. Yet, after reading this article, we hope you better understand the income tax system for Ukrainians in Poland. And if you are wondering how to support your family back home, Profee transfers are your perfect choice.